West Columbia passes 1st reading of budget, water-sewer fees and H-Tax

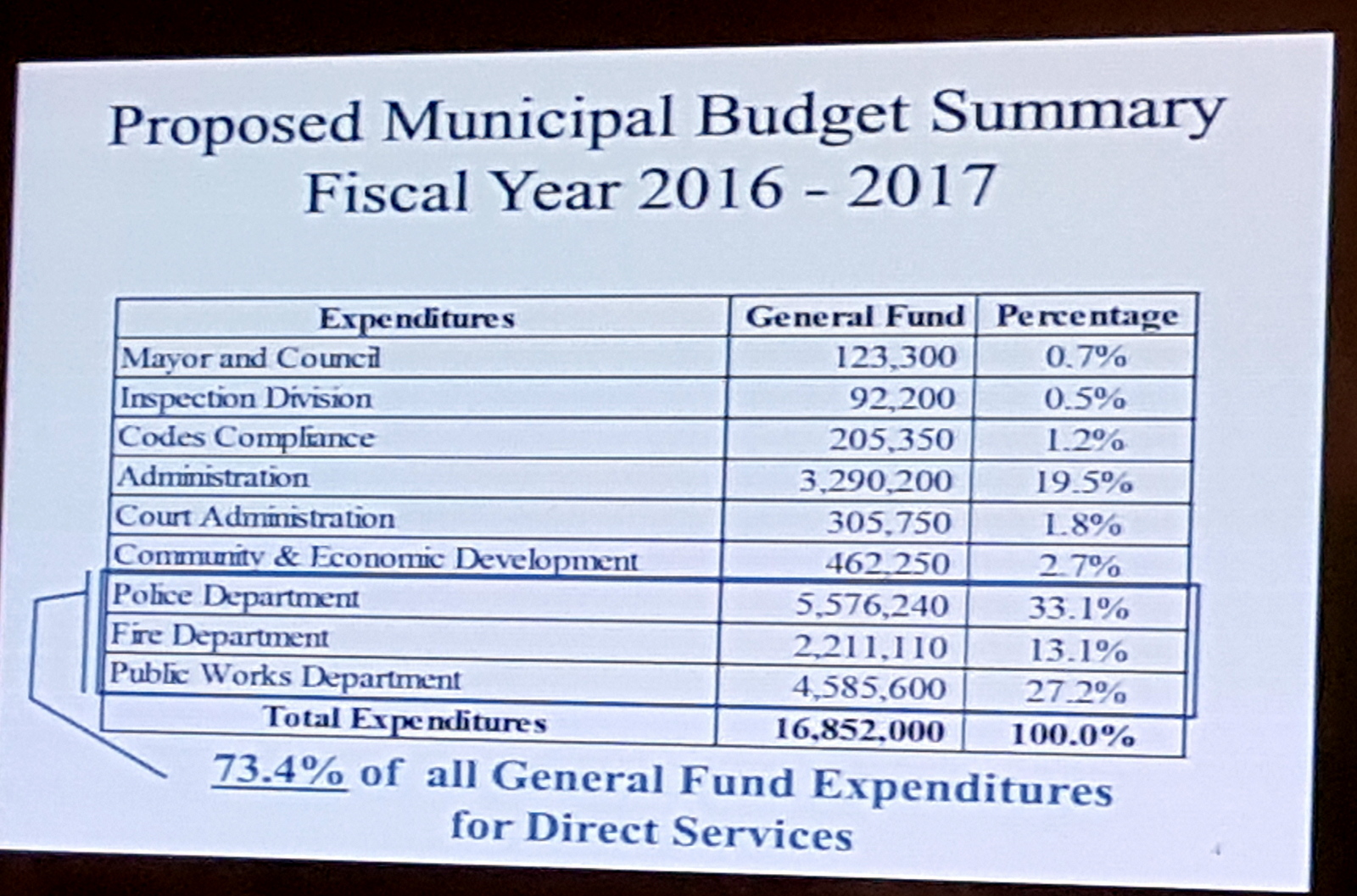

West Columbia City Council, at a special meeting Monday, passed first reading of $16.8 million general fund budget and a water-sewer budget. The water-sewer budget includes an increase in fees of between $4 and $4.50-a-month for in-city customers. That increase is double for out of city users.

Even with the increases in the water-sewer rate, West Columbia is the second-lowest rate of 181 water-sewer systems in the state.

The 2016-17 general fund budget includes a three-percent merit increase for city employees, and a two-percent cost-of-living increase. Insurance costs are up seven percent for the money the city spends on premiums.

Council also passed first reading for the implementation of a 2% Hospitality Tax for prepared food in the city. Nine people offered input during a public hearing on the H-Tax. Seven of those were in favor, and one was opposed. One just asked a question about how the money from the tax would be prioritized.

The H-Tax vote passed 6-2. Councilmen Jimmy Brooks and Tem Miles voted against the tax. Brooks said the people have “no appetite” for any new tax. Miles said with the increase in water-sewer rates, it’s too much, too fast.

The H-Tax must- by state statute- go toward specific projects, that are related to tourism, quality-of-life projects, public events, and assistance to businesses.

Before the public hearing, City Administrator Brian Carter said the city has had “more demand” for services and rising costs. He said there has not been a property tax increase since 2008, and the H-Tax would be an alternative way to generate needed revenue. The H-Tax is projected to add $1 million a year to the city’s budget in the first year, because it would likely be two months after the beginning of the fiscal year (July 1) before the tx could be implemented. Carter said the tax would generate more – up-to $1.2 million) in the second if projections are accurate.