After floods, think insurance policy against disaster in West Columbia

Don’t let your guard down.

September is National Emergency Preparedness Month. A week ago West Columbia dodged a major impact from Hurricane Florence, but city crews were ready and waiting. Cones were put in place to block off roads covered by water and personnel removed fallen trees and branches from some roadways in the city.

While West Columbia missed the brunt of the storm’s wrath, the eastern part of the state was not as lucky. Several rivers in the state, including the Pee Dee and the Waccamaw are rising above flood stage. Just like the flood in 2015, that hit near us, Hurricane Florence took lives. Flooding is a major threat.

Ninety percent of all natural disasters in the United States involve flooding, according to the Federal Emergency Management Agency. Flood damage is frequent in low or moderate risk areas. Even with the frequency of flooding, homeowners insurance policies don’t cover flooding, but some are glad they have it.

Greater Cayce-West Columbia Chamber Board President Steve Cohen was a victim of the 2015 flood.

“I had 14 feet of water in my house,” said Cohen. “When the water started coming into my house, I did not get upset about it, because I knew I had flood insurance.” Cohen said he was required to carry flood insurance at one time, but at the time of the 2015 flood he was not required to it.

“I’m so glad I had coverage that included a flood,” he said. “In 2015, there was no hurricane, but we had prolonged rain. It was a perfect storm.”

Cohen said that it was well worth it to have coverage for the flood, but the insurance didn’t cover everything.

“It didn’t cover my garage, lawn mowers, or my cars, but my comprehensive auto coverage covered my cars,” said Cohen.

Trevor Bedell of Palmetto Insurance lives in West Columbia. He said less than 10 percent of his volume is flood insurance and flood insurance is mostly utilized by homeowners who are required to buy it. But that has changed a little recently.

“There is a heightened awareness of the need for flood insurance after the flood of 2015,” Bedell, a West Columbia councilman, said.

Rachel Livingston Popkowski is vice president of West Columbia’s Livingston Insurance Agency. She also said most clients do not have flood insurance, but it can be well worth the expense.

“Those who live in high risk areas are most likely to buy flood insurance,” Popkowski said. She also said flood insurance is relatively inexpensive for a primary residence and it’s comforting “sleep-at-night” insurance. Cohen agrees.

“Compared to the value of my house, and the amount flood insurance costs, I came out way ahead by purchasing flood coverage,” said Cohen.

For those shopping for insurance FEMA recommends you ask these questions.

If you’re moving into a new home, apartment or business location, ask your mortgage lender, your West Columbia planners or your insurance agent if the location has  been known to flood. The National Flood Insurance Program (NFIP) will also be able to provide flood risk information on your area.

been known to flood. The National Flood Insurance Program (NFIP) will also be able to provide flood risk information on your area.

Cohen said flood insurance is basked by the federal government and most policies are similar.

FEMA also advises “even if you don’t live in a high flood risk area, you’re in some danger of loss from a flood, because 20 percent of all flood claims are filed in low to moderate flood risk areas. That means, you should know how to prepare for the possibility of a flood, know your flood insurance options and obtain adequate coverage.”

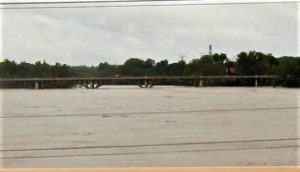

The Congaree River flows by West Columbia. It’s our most treasured natural resource and offers aesthetics and a multitude of recreational opportunities most days of the year. But when there is too much rain, residents should be aware of the risk that comes with the river. So be prepared.