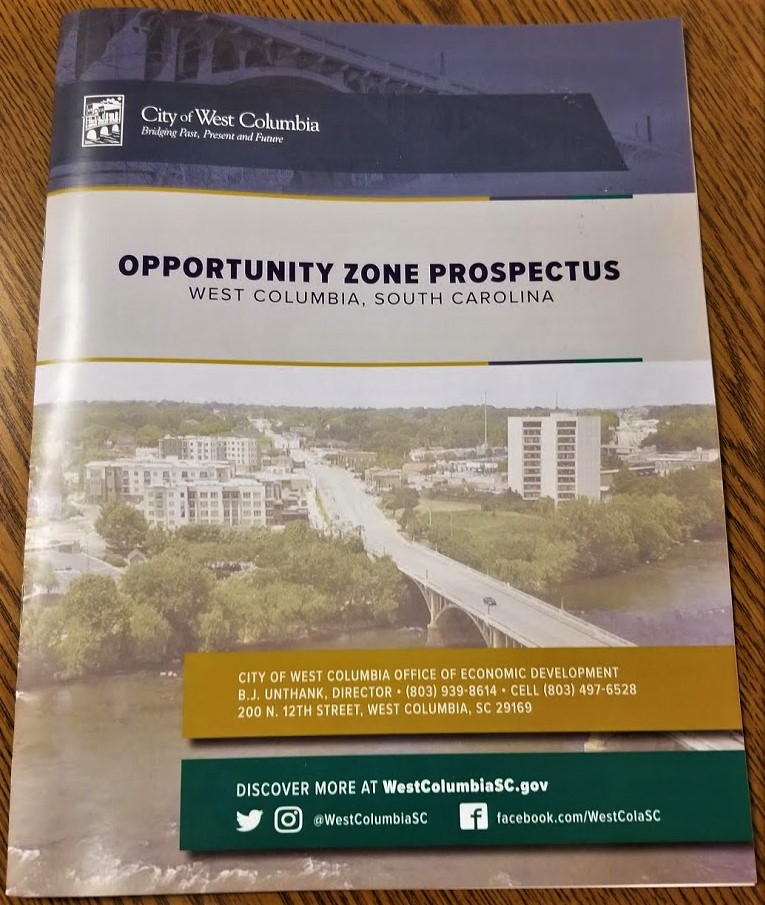

Prospectus highlights West Columbia’s Opportunity Zone status, draws investors to top properties

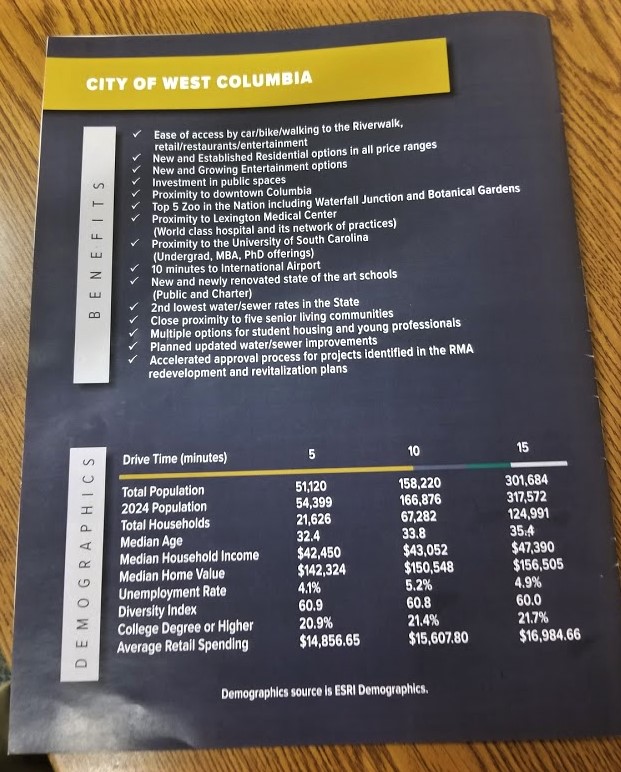

West Columbia is a good place to do business. Now it’s even better.

Gov. Henry McMaster has designated specific West Columbia properties as part of an Opportunity Zone.

Opportunity Zones are provided a capital gains-based, federal tax incentive for investors. The program is designed to encourage long-term private investments in communities that have the potential for a higher level of development.

In order to have been designated an Opportunity Zone, according to McMaster, a community is required to demonstrate its ability to attract private investment.

To get the attention of investors, the City of West Columbia has published a prospectus, highlighting prime properties, ripe for development.

“This prospectus gives any potential business investor everything they need to know about doing business in the West Columbia community,” said Mayor Bobby Horton. “It will help them understand the current business climate, with a great deal of information on our low utility rates, West Columbia’s pro-business attitude, our one-stop shop, and so many other positives.”

Horton said the prospectus is being mailed to 65 individual investors. There is also a link to be provided that allows potential entrepreneurs to see a virtual presentation of the prospectus. Link to Prospectus

The eight properties outlined in prospectus are: 8.6 acres at Capitol Square, 483 Sunset Boulevard; 9 acres at Lakeview School, 1218 Batchelor St.; and 8.6 acres of the Colite Property at 228 and 229 Pearson St.

Other areas that the city is promoting to investors are: two acres at Triangle City, .25 acres in the Brookland development; 3.7 acres at Sunset Boulevard and Leaphart Street; and 2.5 acres at Meeting and N. 12th streets.

West Columbia Mayor Pro-Tem, Tem Miles is an avid supporter of the effort.

“The prospectus is a wonderful way to encapsulate all of the attractive opportunities for investment in West Columbia,” said Miles. “Sending it to the investment community gives them a reason to look into investing in West Columbia.”

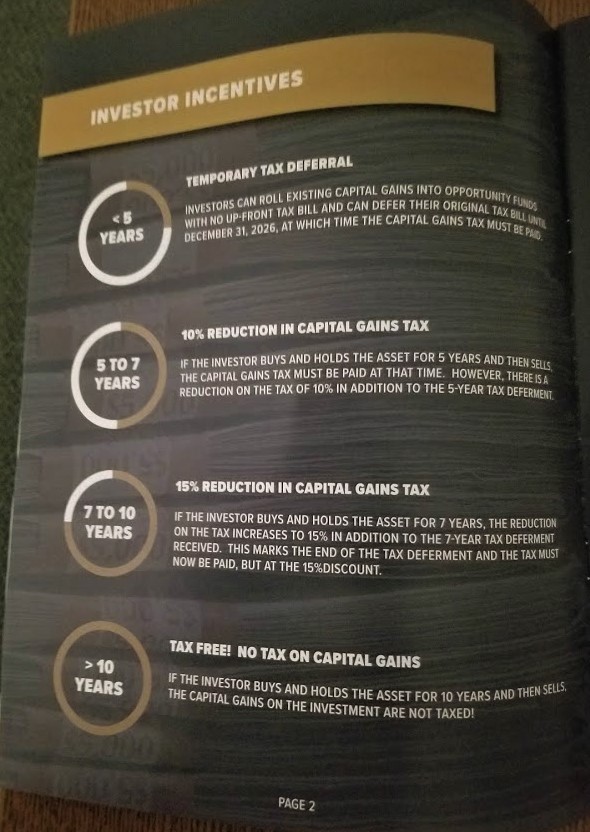

What an Opportunity Zone Offers

The incentive allows an investor in Opportunity Zone areas to defer capital gains tax payments until 2026, and there is a 10 percent reduction of the capital gains tax after five years. If the investor holds the property for seven to 10 years, the capital gains tax is reduced by 15 percent. If the investor holds the property for more than 10 years, there is no capital gains tax.

Horton also said some of the properties are in a Tax Increment Financing, or TIF, district. And that allows for better enhancing of properties in those areas, increasing the value.

In the prospectus, information on the property is provided and potential uses vary. For instance: Capitol Square is described as “Positioned as an anchor of the River District, this catalyst property is positioned to be the gateway to the city.” It said the large “parcel has potential for infill development on the current surface parking lot.”

The Lakeview School property is intended as a medium-density residential area, characterized by single-family homes, and apartments. It’s ideal use, according to the prospectus includes single-family housing.

It is a good time for growth. West Columbia is currently a hot spot for businesses. The prospectus, and the Opportunity Zone designation of multiple West Columbia properties is sure to draw investment, and accelerate the already abundant opportunities.